Other Case Study

I bring valuable experience and a dedicated mindset to any project. Let's join forces and make a positive impact together. Feel free to reach out to me via my Email or LinkedIn

Finances with IPAY, offers seamless management, personalized recommendations, and advanced security in a single, intuitive platform

User Feedback

My Learnings

I conducted moderated usability testing with 10 users to evaluate the app's functionality, ease of use, and overall user experience. During the sessions, users were guided through various tasks while providing real-time feedback, allowing me to observe their interactions and identify pain points. This hands-on approach helped uncover specific usability issues, such as confusing navigation paths, unclear instructions, and design elements that needed refinement.

The following are both positive and negative feedbacks gotten.

Negative feedbacks

Positive feedbacks

Wao, I like this kind of innovation, saving money and doing business at the same time.

So thoughtful, it has lot of features.

I like the on-boarding animation, it makes me feel at home

The navigation is easy and straightforward

The escrow features nailed it all, i will be rest assured to buy anything here since the money is not going straight to the seller, and i will even determine when to release fund if my delivery is exact and complete. I so much love it.

From the on-boarding, you gave 3 types of category to log, I am really confuse as to what category I fall into.

One of the major reason I so much cherish my career path is the fact that I learn from every project I did. It gives me the ability to think beyond the box, be creative and strengthen my ability to make research.

From this particular project, I learnt lot of things and some of them are ;

From my recent course at Interaction design foundation, i learnt about stakeholder meeting and I implemented it in this project and it really helped. It gives me the opportunity to bond and share idea with the stakeholder and to also know more about the idea they have for this project

Building this project was so educative and boosted my intellectual capacity, I want to thank all the users that helped me in figuring out how to solve the problem, and to those that i interviewed , they left their time to support in th project. Thank you all.

The power of UX in a project cannot be overemphasise, it plays a-lot of role in achieving this and I really took my time on it. The user flow, information architecture, Ideation, site mapping and all helped me narrow down my priority and what is best for this project.

I learnt new tactic in figma and more about animations. I make sure my design principles follows the heuristic evolution and proper typography for this project.

I learnt no design is flawless, there will be one error or another however, there is always room for improvement and adjustment, that I can be rest assured.

Stakeholder meeting

Fun & Thank you

UX Principles

UI Principles

Above all

Typeface

Color Scheme

Icons

Logo

Typography & Color Scheme

Logo & Icons

Simple & modern font that reflects boldness was used. The colours were chosen to represent playfulness and a sense of delight to the user.

Visual Direction

Poppins

Poppins is a geometric sans serif typeface, It's elegant & sophisticated, yet modern. It's beautifully legible, offers an excellent reading experience.

Aa

Regular

Aa

Medium

Aa

Semi Bold

Aa

Bold

Aa

Extra Bold

Aa

Primary

Text color ( Tertiary )

Secondary

Style 1

Style 2

Plugs are confusing, what does it mean, I actually taught its another buy and sell area

For the different kind of verification we are to do before exploring all features, I am afraid to give all those details for security reasons.

Designing the Future: Transforming Vision into Reality for IPAY App

Once I organise all my insight in the ideation stage, I then began to to sketch my idea using the user flow as a guide. This allow me to quickly explore several concept of the application layout. I then tested it with 3 participant to validate whether the solution address both the general and business needs.

Afterwards i converted all screens to their hi fidelity actual design that will be displayed for use.

User Flow: Navigating the step-by-step structure of the app

By carefully mapping each step, we ensure the user journey is logical and user-friendly, minimising friction and enhancing overall satisfaction. We did a well-crafted user flow that not only simplifies navigation but also aligns with the users' needs and expectations, making the app efficient and enjoyable to use.

Information Architecture

IPAY’s information architecture is strategically designed to ensure easy navigation and quick access to key features. With intuitive categorisation and a logical hierarchy, users can effortlessly explore financial transactions, online shopping, or business management, making their experience seamless and efficient.

IPAY

Sign up/ Sign in

Phone verification

ID Tag

Home

Airtime

Data

QR code

Profile

Money

Security verification

Market

Services

Plugs

Add

Receipt

Send

Buyer

Seller

Chat your manager

SMS

Call

Document

Message

Fingerprint

Amount

Amount

Category or search

Register

See category or search service

New product arrival

Top seller

Chosen service

Provider nearby

View profile

Follow seller

View catalog

Videos

Make payment

Chat provider

Verification

Personal information

Business profile

Profile set up

Product

Description

Add to cart or Buy

Delivery details

Summary

Payment

Tag name

Description

Confirmation

Pin

Submit

Submit

Card details

Confirmation

Pin

Submit

Successfull

Successfull

Successfull

Select type

Account to debit

Scan QR code

Share QR code

Share QR code

Inbox

Order

Escrow transaction

Edit information

Security settings

Your referral ID

Help center

Giveaway

Generate QR code to your business profile

Select network

Bundle

Mobile number

Confirmation page

Enter pin

Submit

Account to debit

Select network

Amount

Mobile number

Confirmation page

Enter pin

Submit

Successfull

Successfull

Success

Manager

Verification

Nav Bar / Footer

Upgrade

Escrow

Account

More

Ideated Features: Transforming Insights into Innovative Solutions

The insights gathered from user research were instrumental in designing features that directly tackle the users' challenges. Below are the solutions the app developed to address these issues.

Identifying Pain Points: Uncovering User Challenges and Frustrations From Research

Through a thorough analysis of the survey data, a card sorting and affinity mapping exercise was conducted to categorise and consolidate the identified problems. Similar or interconnected issues were grouped together to unveil the following pain points.

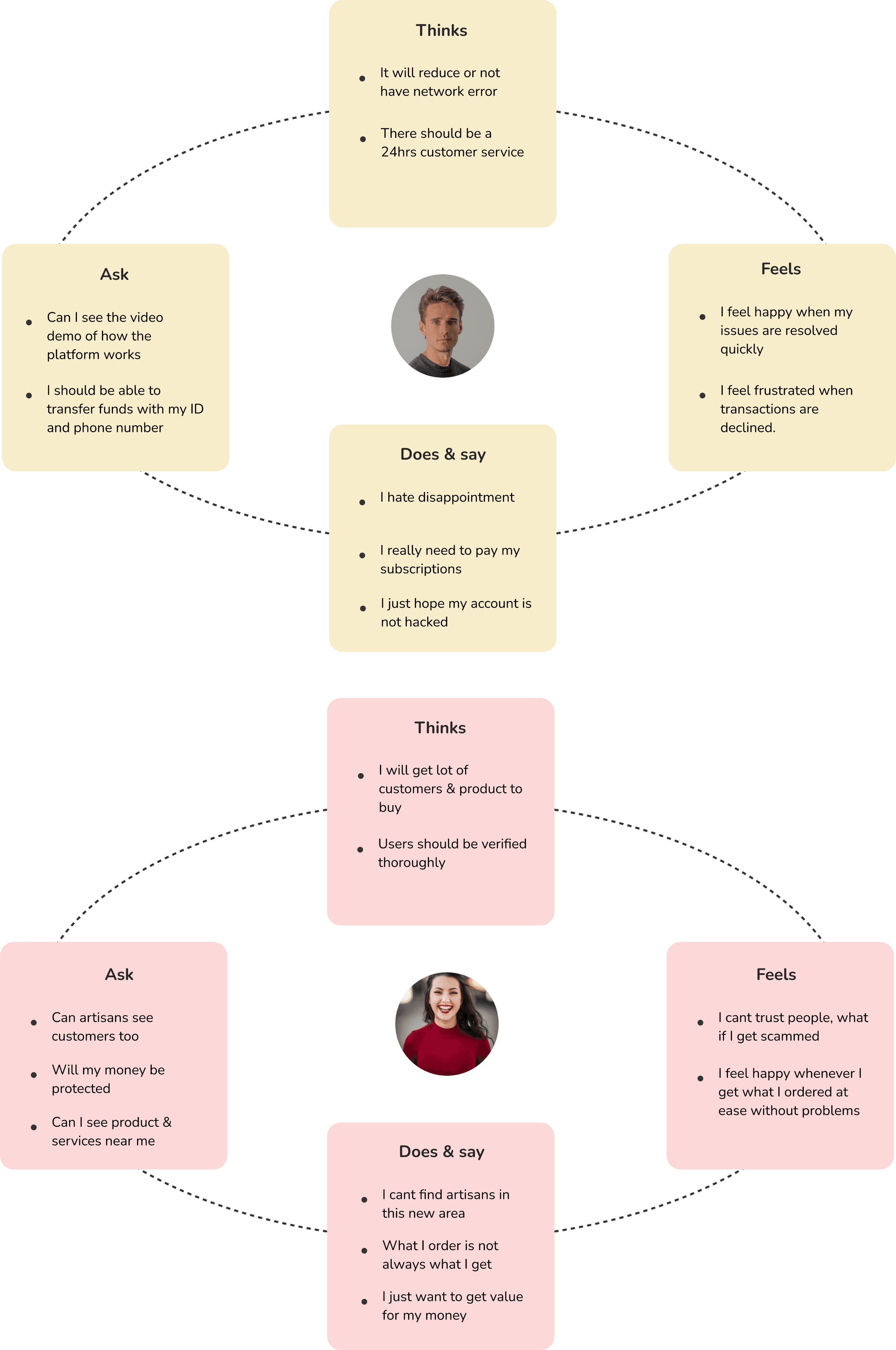

Empathy Mapping: Understanding User Thoughts and Feelings

In order to truly understand and empathise with our users, we delved deep into their thoughts, feelings, and motivations through the process of empathy mapping. This powerful technique allowed us to step into their shoes, seeing the world through their eyes and experiencing their challenges and aspirations. By capturing their emotions, needs, and desires, we gained invaluable insights that guided us in crafting a solution that resonates with them on a profound level.

Define Phase

Ideation Phase

Design Phase

Usability Testing Phase

Understanding The Users: Creating User Personas

In our quest to deeply understand and empathise with the users, we embarked on a journey of discovery to create user personas. We delved into the lives, aspirations, and pain points of individuals who would benefit from IPAY, giving them faces, names, and stories.

Peter Joseph

Khyler Smith

Bussiness man

Fashion Designer

Reading

Shopping

Football

Pictures

Games

Outing

Single

Female

30years

40years

$8,000

$2,000

Marital Status

Gender

Age

Age

Profit

Income

90%

55%

Keeping money & Doing business

Online business

About

About

Goals & Need

Goals & Need

Peter Joseph is a business man that makes profit of 8,000 dollars monthly, he is happily married and 30years of age. He hates when he is in the middle of money business there is network error or recipient does not receive money that was sent by him, he gets so frustrated easily.

Khyler is a fashion designer that needs additional income to sustain herself, she has hand work skill that sells online, she lost customers because they are afraid of getting scammed and not delivering what they order online.

Peter goal and need is to see a platform where he can easily transact his funds and have easy access to customer care to resolve issues as soon as possible.

Khyler goals and need is to see a platform where money transaction between buyer & seller can be regulated so they don't get scared of been scammed.

Discovery Phase

Survey Analysis

We asked 300 people about their experiences using fin-tech platform through in dept interview and surveys. Their answers helped us understand the problems they faced. We use this information to make our platform better and easier to use.

Unveiling Key Questions: To Understand the Needs and Expectations of IPAY Users

Developing IPAY was driven by extensive user research, where my team conducted interviews and observed users’ financial and business activities, gaining firsthand insight into their challenges. Inspired by these interactions, we crafted key questions designed to uncover users’ needs, motivations, and expectations.

—What are the key financial challenges users face in their daily lives?

—How do users currently manage their financial transactions and online shopping activities?

—What features or functionalities are users looking for in a fintech and business app?

—What are the pain points or frustrations users experience when conducting financial transactions or engaging in online shopping?

—How do users perceive the security and trustworthiness of existing fintech and e-commerce platforms?

—How do users envision incorporating their businesses or products into a fintech app for wider reach and growth?

—Are there any specific financial or business management challenges faced by users in their respective industries?

—What are users' thoughts on incorporating marketing and promotional features within a fintech app to support their business growth?

Competitive Landscape Analysis: Assessing the Market and Industry Players

A thorough competitive analysis was conducted to identify their key strengths, weaknesses, and market positioning of 5 different companies. By examining their features, pricing strategies, target audiences, and customer feedback, we were able to gain valuable insights into the competitive landscape.

Unresolved problem challenges in the Industry that was identified include:

Solution

IPay offers a comprehensive solution for secure and efficient online transactions. Key features include identity verification, digital wallets, escrow services, a marketplace, bank account integration, dispute resolution, a product locator, and promotional tools. These features aim to create a safe and convenient environment for both buyers and sellers.

6:53

My Role

UX Designer and

Project Lead

The Team

3x UX Designers

5x UI Designers

15x Developers

My Responsibility

Collaborate with Stakeholders

Create wire-framing & Prototypes

Virtualise & Iterate on Design concept

Design intuitive user interfaces

Conduct Usability Testing

Gather feedback

Improve UI Design

Collaborate with Developers

Stay Updated with Industry Trends

Maintain Design Consistency

Tools Used

Miro board

Figma

Google meet

Google form

User research

User persona

Site map

Wire frame

Feedbacks

User interview

Empathy map

User journey

Hi-fi

Conclusion

Competitive analysis

Ideated features

User flow

Prototype

Future features

Design Process

Discover

Define

Ideate

Design

Testing

Project Overview

IPay was created to address the challenges faced by individuals and businesses in managing their finances and growing their ventures. Traditional financial services often lack the security, convenience, and accessibility needed in today's fast-paced world. Additionally, many entrepreneurs struggle to reach a wider customer base and showcase their products effectively

Design Goals and Objective

My team and I set the primary goals objective to include making money and business transaction of the user safe, secured and reliable. Making money is very fundamental to human, and lot of users make it through doing business and transacting with different people. We want to make the platform so seamless and easy for users to use.

Problem Statement

There are lot of fin-tech apps, most of them are not really reliable and deduct unnecessary charges with no justifications.

I find it difficult buying goods online especially with unknown people

Lot of commercial and business app but there is no escrow or third party system to secure payment on both side

I don't trust unknown people with my money, scams everywhere

Most of the time, items purchase online do not really come out with what user expected because its not regulated.

Understanding User Perspectives From Research Finding: Analysing Affinity Mapping

From our research findings through affinity mapping, we discovered important insights that shed light on what our users truly desire and struggle with. These insights became our guiding compass, leading us to create a solution that truly meets their needs and aspirations.

The following key insight from user survey emerged;

Insight #1: Users expressed frustration with the limited functionality of the app, primarily focused on financial transactions.

Insight #2: The majority of respondents emphasised the importance of security and trust in their financial transactions.

Insight #3: Users expressed interest in an integrated e-commerce feature within the app, allowing them to conveniently shop for goods and services.

Insight #4: A significant portion of users indicated a desire for personalised offers and promotions tailored to their preferences.

Insight #5: There was a strong demand for accessible customer support channels and prompt resolution of issues or concerns.

Insight #6: Users emphasized the need for continuous innovation and adaptation to meet their evolving needs in the fast-paced fintech landscape.

Registration

Money Transactions

Business Transactions

Market Transactions

Home & Verification page

Incase the buyer want to purchase directly from the seller, user can chat up the seller from their profile